24th April 2019

Article written by Boris Petrovic, conference director and content lead for the 7th Australian Domestic Gas Outlook 2019 (Sydney, 4-7 March), Australian Energy Week 2019 (Melbourne, 11-14 June) and the Australian Hydrogen Forum 2019 (Sydney, 18-19 Sept).

The Australian Domestic Gas Outlook 2019 conference recently hosted a day dedicated to helping gas market participants understand the commercial opportunities that the rise of hydrogen presents to the sector.

The conference, called Hydrogen & Gas 2030, was a highly fruitful gathering with many insights emerging from those leading the H2 industry. Below is an outline of some of the salient issues and insights that will define the discussion on Australian hydrogen for the coming year and beyond.

Social license to operate

The energy sector in Australia is the least trusted by consumers at present, ranking higher than the banking sector which has held the top spot since the 2008 global financial crash. A mixture of high prices and confusing offers, where loyal customers in some cases are penalised with higher electricity bills, has resulted in mistrust of energy retailers and, by association, the wider energy market.

The hydrogen industry will exist within this market ecosystem and culture, and therefore should make an especially conscious effort to secure a social licence to operate early. Social licence was a significant point of emphasis by Alison Reeve, who is the taskforce leader for the Chief Scientist’s National Hydrogen Strategy.

Hydrogen is a fuel that has the theoretical virtue of being able to extend humans’ continued existence on earth in the long-term by halting carbon emissions. Its sustainability will carry significant PR weight relative to other energy sources. However, industry participants should still think long and hard about its likely impact on water resources, energy prices, community relations, as well as general PR and public understanding of the technology and its safety.

The main mechanism for confronting the social licence issue early would be the emergence of one or more strong hydrogen associations, Hydrogen Mobility Australia being the obvious candidate, which can collectively coordinate both accurate communication of hydrogen industry benefits and negotiate, on a collective level, as to how it will compete with other large industry interests. Mitigating negative community impacts and creating economic opportunity for Australians proximate to the projects on-the-ground should also be key considerations. Currently there isn’t a clear central association that does this (as the industry hasn’t taken off just yet), but an organisation around which the industry can coalesce to address these issues will be required. Also, the fact that Australia could have a clean, sustainable and ethical hydrogen supply chain can augment the brand of Australian Hydrogen to charge a premium, on top of the quality of the gas being produced, when competing for supply contracts in the international market.

H2 in policy - domestic industry vs export, state and federal

During the midday presentation we heard from Taekyong Song, senior research engineer for the Hydrogen Research Team at KOGAS. KOGAS is the South Korean government-owned gas company and the world’s biggest purchaser of LNG. Australian companies such as Woodside Energy are a significant supplier to KOGAS which is then charged with meeting South Korea’s energy needs. The country, like Japan, has a dearth of natural energy resources at its disposal so it relies on fuels imports from Qatar, Australia, Oman, Malaysia, Indonesia and Russia. The presentation by Mr Song confirmed what many delegates were expecting to hear: The South Korean government is very serious about the transition to a clean fuel economy with hydrogen being a part of the plan.

The same goes for other key Asian export markets, such as Japan and the huge commercial prize, China. China aims to drastically cut emissions for climate and pollution reasons so hydrogen can provide a great way to address both issues. Practically every presentation, from Woodside Energy, ARENA and others, pointed to the lucrative export potential of hydrogen.

Although, there were tales of caution, chief among telling them was Rosemary Sinclair, CEO of Energy Consumers Australia, about the export-orientated thinking among commercial players in the budding H2 sector. The story of when Australia globalised its domestic gas market via Gladstone and the north-west shelf could very well repeat itself in the form of hydrogen. Lessons from Australian LNG export story must be learnt, where an overbuilding of export terminals and long-term contracts to Asian buyers eventually led to a gas price crisis on the east coast which in turn put manufacturers at risk and lead to the threat of hard political interference.

Western Australia’s domestic gas reservation policy could act as inspiration for the coming Federal government which will need to have a hydrogen policy line, in one form or another. If the interests of domestic stakeholders are not considered, the industry could find itself in hot water. It is necessary to satisfy stakeholders at home before you can do so abroad being the overarching point.

The promise of export market opportunities was the incentive that lead Australia to develop one of the largest gas sectors in world, so can there be a way to balance the two: export market opportunities leading to massive growth potential through private investment, and well-thought-out policy and regulation ensuring domestic stakeholders are looked after?

All this is jumping the gun, given the amount of investment and work that needs to be done before the cost of hydrogen is palatable for Asian buyers, but it should be embedded in policy now rather than later.

On another export-type point, Murray Lyster, head of hydrogen solutions for Siemens Australia, raised the salient suggestion that it does not need to be simply hydrogen gas itself (or the H2 transport molecule, ammonia) that is sold to the world. Investment should be made to create a culture of hydrogen innovation in Australia that would position it as a leading provider of expertise and technology that can also be sold.

Hydrogen in federal and state policy will also need to be coordinated so that the various States are complimentary to each other’s efforts, rather than in competition. Currently, they are making their own agenda with Western Australia, Victoria, South Australia and Queensland setting up roughly independent strategies. An uncoordinated State-by-State approach can potentially create issues at the national level and slow progress without federal government leadership.

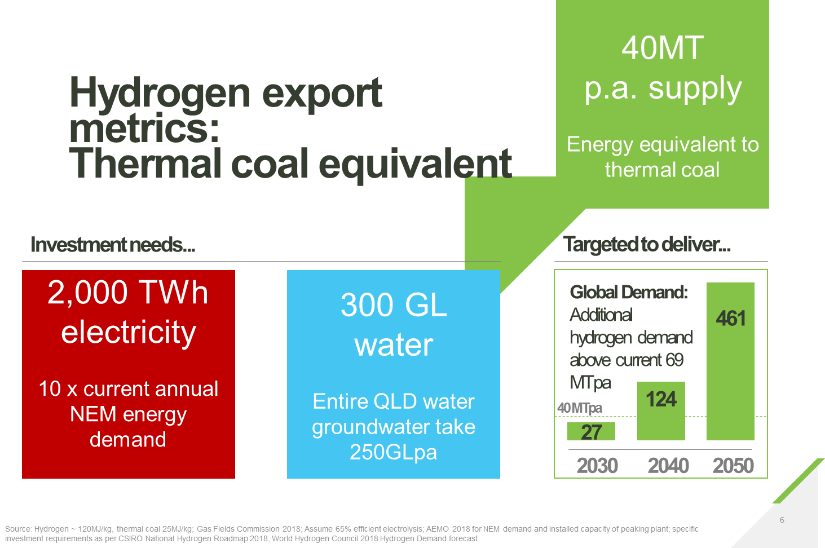

Comparison with coal - electricity and water requirements

Aurecon’s director of future energy, Sam Button, gave one of the most insightful presentations of the day with a technical breakdown of the required amount of water and electricity needed to generate the equivalent amount of energy in hydrogen form as the current Australian thermal coal export industry (See Graph 1 below). The vast figures made for rather sober reading to anyone that thought the creation of a hydrogen industry would be a straightforward process. Aurecon estimates that it would take 300 gigalitres of water (Queensland’s entire yearly groundwater take is 250 gigalitres) and 2,000 Terawatt hours of energy (10x what the National Energy Market currently is using per year) to make Hydrogen exports reach parity (in energy terms) with that of the amount of thermal coal being exported. It should be stated right-off that while this gives us a benchmark, a comparison to thermal coal export volumes might be a little extreme considering Australia is the Saudi Arabia of coal, and therefore to set a target of hydrogen production equal to that amount may be a bit over-the-top. These vast figures however (especially the 2,000 Terawatt hours) should be seen as a huge opportunity for renewable generators says Mr Button which would give energy producers a reason to churn out as much energy as possible in order to convert it into H2. And as coal demand is scaled back globally, renewable generators can look to move into the vacant market share left by coal and, potentially down the line, natural gas.

Graph 1: Aurecon’s analysis of the amount of water and electricity needed to produce an equivalent amount of hydrogen energy as current total exports of thermal coal

In a country that has only recently emerged from one of the worst droughts in its modern existence, water will be one of the defining issues as to whether a big hydrogen industry is viable. Practical questions such as whether the use of State’s desalination plants can be made available for H2 and where the raw water resources will come from, must be addressed.

Electricity supply may also be a problem as the NEM is not entirely in the healthiest of states to have another massive demand sector added to the top of it. The current wisdom is that ‘excess’ energy that is wasted due to lack to market demand (e.g. when the wind turbines are spinning away and people don’t have their lights on or factories don’t need it) can be stored as H2 and used later on (when the lights are on and the factories are pumping). Although how much of this excess energy there is not easy to define.

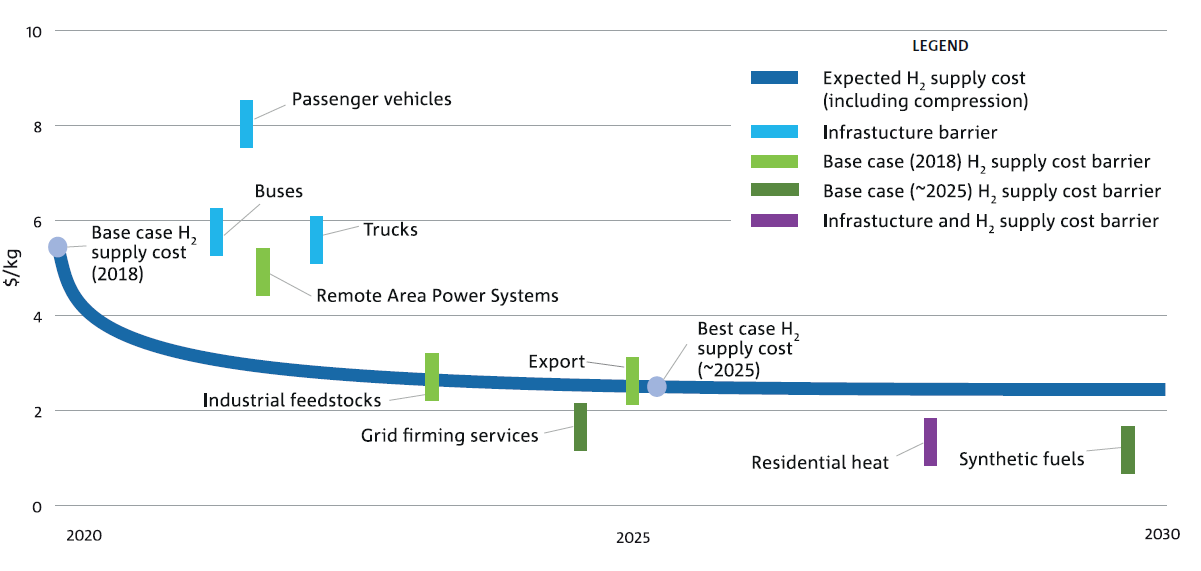

Graph 2: From CSIRO’s National Hydrogen Roadmap - approximate cost of hydrogen and resultant demand diagram

Graph 2, first shown at the conference by Daniel Roberts, leader of the Hydrogen Energy Systems Future Science Platform at CSIRO, shows the estimated cost of hydrogen per kilogram and the expected demand at different price levels for different purposes. A H2 price and resultant demand diagram. It shows estimates of the price of hydrogen decreasing, as a result of economies of scale and technical efficiency improvements in production. Hydrogen is expected to be ‘exportable’ when this figure reaches a little over $2 per kilo.

Given that the main ingredients needed to produce hydrogen are water and electricity, in order to reach this $2.2/2.5-per-kg level, it’s conceivable that H2 could lead to further disruption of the energy sector, drive up consumer prices and result in resource scarcity issues. However, Martin Hablutzel, head of strategy for Siemens, believes that to achieve this level of H2 price, the electricity price underpinning its production would need to be extremely low which can only benefit Australian consumers in the first place. Further, Mr Roberts from CSIRO, argues that hydrogen has intrinsic benefits from being an effective storage mechanism, and therefore can lead to grid stabilisation and, in turn, electricity price management. All this should mean that H2 could greatly benefit the NEM and energy customers.

When asked to give his thoughts on this article, AGIG’s chief executive, Ben Wilson, also disagreed with the assertion that hydrogen production could lead to disruption of the NEM. Mr Wilson argues that ’’if hydrogen is used domestically, for example in heating homes via gas networks, then assuming Australia actually decarbonises its energy sector, the alternative way to a carbon-free system would be direct electrification anyway’’. Referencing the Deloitte study on Victoria, Mr Wilson said that ’’direct electrification of heat would place more stress on the electricity system and require massive electricity storage to be built, because of the lack of pipeline storage in the state’’. Mr Wilson went on to say that electricity for hydrogen export is unlikely to be NEM-connected but more-likely to have its own dedicated solar and wind arrays such as in the Pilbara, and therefore H2 production will not have a direct impact on the NEM. Although, this development may present renewable generators with an opportunity cost as they will have a choice on which market they service: the NEM or the export market, or both.

Lastly, end-use considerations need to be investigated. For example, the simple and seemingly harmless fact that the combustion of hydrogen will give off a by-product: water. How will this play out in large-scale usage in mobility? For example, will our roads be damp most of the time or will drivers need to dump the residual water periodically? It seems harmless enough but the point remains that unforeseen implications could either be a nuisance or something more damaging. The trials exploring hydrogen appliances should ensure they undertake rigorous environmental and social impact studies to fully grasp any unforeseen effects.

Lots of technical barriers to overcome and it’s going to take A LOT of money

Labor’s Shadow Assistant Minister for Climate Change & Energy, Pat Conroy MP, presented at the forum and outlined the party’s policy commitment of over $1 billion to be set aside for H2 R&D, infrastructure investment and other related projects. There were no credible estimates that the author to this article found on how much would be necessary to make the H2 industry on par with that of the coal or LNG sectors. The LNG sector made a collective investment of over $90b in the three QLD projects, according to respected gas industry analyst Mark Samter from MST Marquee, to reach its current capacity. This figure wouldn’t be the worst benchmark to start with but could be a lot higher as the gas extraction technology was already pretty mature by the time Gladstone exporters were receiving signed contracts from Asia. The only way to achieve this staggering number will be in commercial bits and segments that eventually make up a mighty whole and, once again, the planning for this should be embedded in federal and state policy.

If that figure ($90b for the sake of argument) is even close to being reached, the whole spectrum of investors will need to be on board, especially super funds, green bond issuers and other investors with more-explicit environmental mandates as part of their portfolio governance. At present, the financial community (whether investor and lender) needs to acquire the knowledge and comfort to be able to understand the risks associated with H2 engagement so they can quantify them to make accurate decisions.

Make no mistake, it will take billions in collective investment in R&D and infrastructure alone to get the cost of hydrogen and accessibility to a state where it is a viable fuel alternative. For this to happen the finance community needs to invest in understanding the technical and commercial nature of H2 projects as without this familiarity there is unlikely to be the adequate level of investment needed.

There is still much depending on the surmounting of technical challenges such as solar cell efficiency, efficiency of water electrolysis, economical hydrogen storage in pipelines and desalination technology for water availability, among a plethora of others. Public sector money should drive much of this innovation, as privatisation of discoveries is likely to result in patent protection that won’t drive collective industry progress. ARENA, CSIRO and the Clean Energy Finance Corporation will be looked to especially on this technical front to unlock breakthroughs. Renewables energy generators, which are expected to produce green hydrogen were markedly in short supply at Hydrogen and Gas 2030 a month ago, but they will need to invest heavily also.

The realities of physics and energy loss between physical states

Elon Musk, a firm advocate of straight-up electrification and battery technology to the issue of decarbonisation and energy reliability, thinks that using energy to produce hydrogen, only to then turn it back into electricity, is nonsensical from an energy efficiency point of view. He is heavily invested in batteries, financially and spiritually, but this is a very crucial point – energy is inevitably lost when transferred between physical states. Therefore, the economics of energy transfer in production, transportation and use need to make sense. The key issues surrounding technical questions, such as the cost of electrolysers, water availability, desalination, and other associated technical issues still need to be solved. And while technical questions are often solvable providing the economics make sense, the two invariably go hand in hand.

Australian H2 as an inspiration for a sustainable world

All countries with a high-degree of renewables penetration in the energy mix could produce green hydrogen. While those with lots of fossil fuel resources on their territory could produce blue or brown hydrogen, providing that carbon capture and storage tech is actually effective (which is a big ‘if’) and they want to produce a sustainable product. Australia could be the country that bequeaths to the world a stable climate through its technical leadership on H2.

And despite his current scepticism, Elon-Musk-like ambition and big-picture thinking will be needed to bring about a hydrogen sector so that it may become the hope all reasonably-minded people are looking for. Hydrogen would not need to rely on capacious carbon emissions reduction policies, such as the Paris accord, to halt climate change. Hydrogen can provide an economically-organic carbon abatement mechanism that is driven by the invisible hand of self-interest among fuel consumers and producers. This phenomenon is less affected by the vicissitudes of politics and therefore all the more powerful.

It is with this in mind that a lot will be expected of the Chief Scientist’s, Dr Finkel’s, National Hydrogen Roadmap, due provisionally in December 2019, as to how the aforementioned challenges will be addressed and overcome.

Australian Hydrogen Forum 2019, 18-19 September, Sydney

We are hosting the Australian Hydrogen Forum in Sydney, 18-19 September 2019. The conference will address the range of policy, commercial and technical questions that need to be debated for a hydrogen industry to come into being. The event will be the tent to host all professionals with a stake in the future hydrogen economy from CEOs, to commercial directors, asset managers, to technical engineers and project managers.

Progress on hydrogen is slow and the volume of meetings is outpacing substantive developments at present. As the conference organisers, we’ve looked to make the content much more focused on open discussions that move progress forward rather than being a descriptive (often repetitive) outline of what those organisations that are engaged in the H2 journey have done already.

The point of the meeting will be to genuinely engage professionals that will compose the future H2 value chain to discuss and debate the commercial and technical challenges that need to be overcome for a theoretical industry to become a real one. An honest and progressive discussion which aims at truth, rather than a talking shop, is what the conference will be all about.

If you would like to be kept informed or involved, please register your interest here.

If you have any questions or comments regarding this article or how to get involved in the conference, please get in touch with aleksz@questevents.com.au.